The problem with getting to 53 years of age.

Here's some food for thought and another reason why getting professional help from a financial planner is worth serious consideration.

Previous articles in this series, which are based on research conducted by Vanguard Investments Pty Ltd, show that a financial planner adds around 3% to what would be the expected return of an investment portfolio. In other words, they provide the expertise and time needed to help you attain your retirement goals and they can help cover their costs at the same time.

However, more research from the Vanguard Investments stable focuses on the significance of the age of 53.

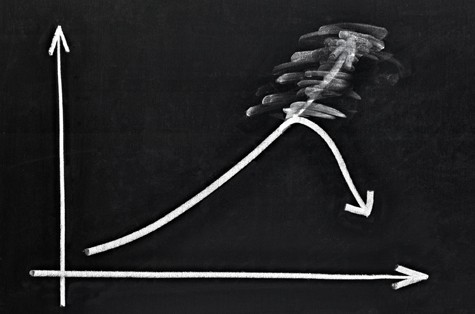

53 is when most of the costs of parenthood are on the decline, a cause for great celebration, but, sadly, it seems declining also is our 'financial capability'. This research has its fair share of confusing terms and definitions such as 'crystalised intelligence' (‘wisdom’ to you and I), 'fluid intelligence' (which peaks, unfortunately, in our early 20's); and 'financial capability'.

When all this is mixed together and the graphs and charts have been drawn the result is that 'the peak age for financial decision-making is…53!'. Ouch!!, and at a time when most of us need the opposite to be true, ‘c'est la vie’.

While many of us are still capable, this research indicate that after we reach 53 another benefit of employing the expertise of a financial planning practice is that their input is provided when we need it the most. That is, during the final 10 year run up to retirement, when there's still time to generate the retirement outcomes you want.

The following are some of the big decisions to be made around the age of 53.

• How do we make the transition to retirement?

• How do we structure our finances to generate an income and deliver capital gains?

• How do we maximise our government entitlements?

• What tax issues need to be considered?

• Will we have enough given our current financial position?

These are big decisions and when relying on your own resources, it’s worth remembering that sometimes we just don’t know, what we don’t know!

Peter Graham

BEc, MBA

General Manager

PlannerWeb / AcctWeb